Two-time Pulitzer Prize winner David Horsey is a political commentator

My friend Evelyn is always gleeful when she catches me saying something pompous or dumb. As soon as I arrived for a visit in San Francisco last Saturday, she began giving me grief about something I wrote in a column last week. Getting a ride from Uber, I had declared, "would make me feel morally compromised."

Well, OK, I admit the phrase was overly dramatic (not to mention that I easily allowed myself to be "compromised" when Evelyn's husband called up Uber and we all jumped into the hired car for a ride across town). My point was not that Uber is more exploitative than many other sectors of our economy, but that Uber is symbolic of how American capitalism has evolved in the last couple of decades -- thanks to technological change, globalization, lax regulation, political stupidity and good old greed -- to give ever-expanding power to people with vast amounts of money while throwing the majority of us into a frantic pool of cheaper and cheaper labor.

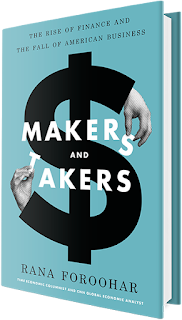

Economic columnist Rana Foroohar does a much better job describing the demerits and perils of our new economy in TIME magazine. Ms. Foroohar's cover story may be the most enlightening piece I have read this election year and I recommend it to everyone, in particular all the candidates running for high office who generally spout ideas about the economy that seem stuck in 1980, if not 1955.

Ms. Foroohar's thesis is that the decline of the American middle class, the sluggish labor market and anemic business development can largely be attributed to an extreme imbalance in global economics that favors the financial sector over all else.

According to Ms. Foroohar, "America's economic illness has a name: financialization. It's an academic term for the trend by which Wall Street and its methods have come to reign supreme in America, permeating not just the financial industry but also much of American business. It includes everything from the growth in size and scope of finance and financial activity in the economy; to the rise of debt-fueled speculation over productive lending; to the ascendancy of shareholder value as the sole model for corporate governance; to the proliferation of risky, selfish thinking in both the private and public sectors; to the increasing political power of financiers and the CEOs they enrich; to the way in which a 'markets know best' ideology remains the status quo."

In the new American economy, banks would rather put money into high-yield, risky financial schemes than loan money to small businesses. Short-term gains for stockholders and CEOs are invariably given priority over the well-being of employees and the long-term viability of companies. Dangerously, debt has become the prime economic driver, whether one is talking about consumers, banks or businesses.

Ms. Foroohar points out that the financial sector gobbles up a quarter of corporate profits while creating just 4 percent of American jobs. This has the effect of sucking all the economic air out of the room, she says, quoting a former Goldman Sachs banker who described the economy as "a zero-sum game between financial wealth holders and the rest of America."

My friend Evelyn is always gleeful when she catches me saying something pompous or dumb. As soon as I arrived for a visit in San Francisco last Saturday, she began giving me grief about something I wrote in a column last week. Getting a ride from Uber, I had declared, "would make me feel morally compromised."

Well, OK, I admit the phrase was overly dramatic (not to mention that I easily allowed myself to be "compromised" when Evelyn's husband called up Uber and we all jumped into the hired car for a ride across town). My point was not that Uber is more exploitative than many other sectors of our economy, but that Uber is symbolic of how American capitalism has evolved in the last couple of decades -- thanks to technological change, globalization, lax regulation, political stupidity and good old greed -- to give ever-expanding power to people with vast amounts of money while throwing the majority of us into a frantic pool of cheaper and cheaper labor.

Ms. Foroohar's thesis is that the decline of the American middle class, the sluggish labor market and anemic business development can largely be attributed to an extreme imbalance in global economics that favors the financial sector over all else.

According to Ms. Foroohar, "America's economic illness has a name: financialization. It's an academic term for the trend by which Wall Street and its methods have come to reign supreme in America, permeating not just the financial industry but also much of American business. It includes everything from the growth in size and scope of finance and financial activity in the economy; to the rise of debt-fueled speculation over productive lending; to the ascendancy of shareholder value as the sole model for corporate governance; to the proliferation of risky, selfish thinking in both the private and public sectors; to the increasing political power of financiers and the CEOs they enrich; to the way in which a 'markets know best' ideology remains the status quo."

In the new American economy, banks would rather put money into high-yield, risky financial schemes than loan money to small businesses. Short-term gains for stockholders and CEOs are invariably given priority over the well-being of employees and the long-term viability of companies. Dangerously, debt has become the prime economic driver, whether one is talking about consumers, banks or businesses.

Ms. Foroohar points out that the financial sector gobbles up a quarter of corporate profits while creating just 4 percent of American jobs. This has the effect of sucking all the economic air out of the room, she says, quoting a former Goldman Sachs banker who described the economy as "a zero-sum game between financial wealth holders and the rest of America."

No comments:

Post a Comment

Comments are moderated and generally will be posted if they are on-topic.